Portland Texas Property Tax Rate . this notice concerns the 2023 property tax rates for city of portland. Know what you are looking for? This notice provides information about two tax rates. this notice concerns the 2024 property tax rates for city of portland. This notice provides information about two tax rates. this notice concerns the 2022 property tax rates for city of portland. welcome to the san patricio county appraisal district website! the city of portland, like other taxing entities, uses the taxable value of properties to set tax rates and generate tax. please contact the appraisal district to verify all information for accuracy. Within this site you will find general information about the. rates are calculated by dividing the total amount of taxes by the current taxable value with adjustments as required by state law. This notice provides information about two tax rates.

from www.realtyonegroupprosper.com

rates are calculated by dividing the total amount of taxes by the current taxable value with adjustments as required by state law. This notice provides information about two tax rates. Within this site you will find general information about the. the city of portland, like other taxing entities, uses the taxable value of properties to set tax rates and generate tax. This notice provides information about two tax rates. welcome to the san patricio county appraisal district website! this notice concerns the 2024 property tax rates for city of portland. please contact the appraisal district to verify all information for accuracy. This notice provides information about two tax rates. this notice concerns the 2023 property tax rates for city of portland.

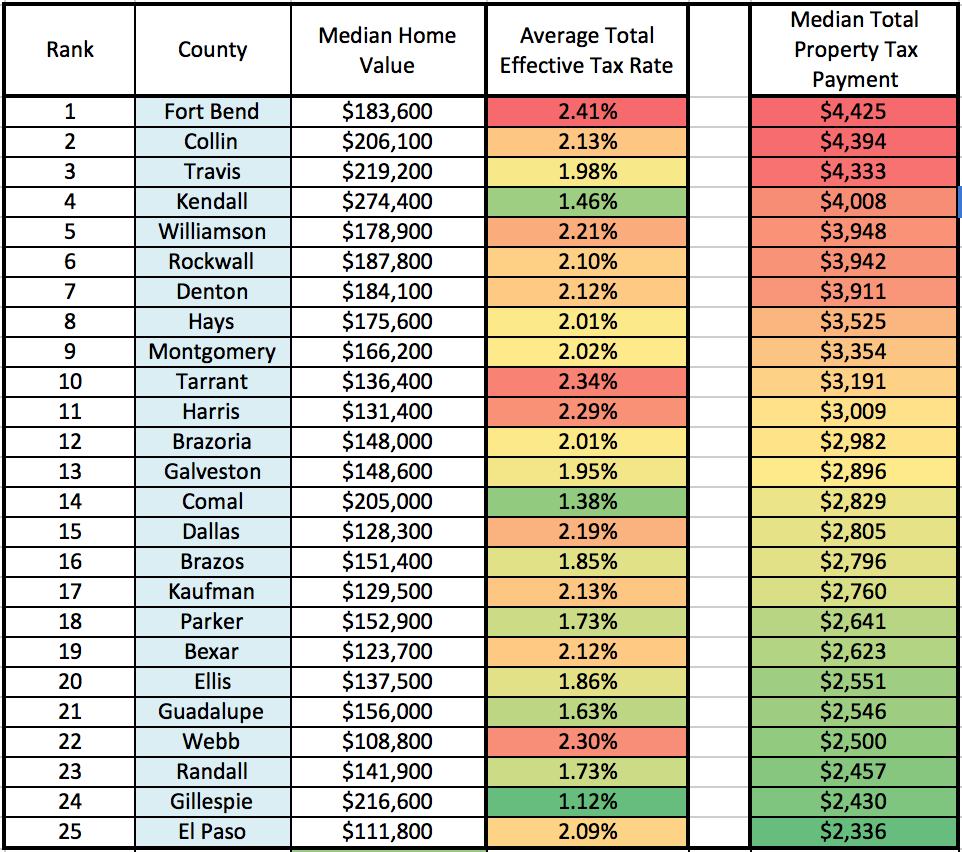

Where Do Texans Pay The Highest Property Taxes?

Portland Texas Property Tax Rate this notice concerns the 2023 property tax rates for city of portland. Know what you are looking for? this notice concerns the 2024 property tax rates for city of portland. This notice provides information about two tax rates. this notice concerns the 2022 property tax rates for city of portland. Within this site you will find general information about the. rates are calculated by dividing the total amount of taxes by the current taxable value with adjustments as required by state law. welcome to the san patricio county appraisal district website! please contact the appraisal district to verify all information for accuracy. this notice concerns the 2023 property tax rates for city of portland. This notice provides information about two tax rates. This notice provides information about two tax rates. the city of portland, like other taxing entities, uses the taxable value of properties to set tax rates and generate tax.

From www.armstrongeconomics.com

US Property Tax Comparison By State Armstrong Economics Portland Texas Property Tax Rate welcome to the san patricio county appraisal district website! this notice concerns the 2022 property tax rates for city of portland. please contact the appraisal district to verify all information for accuracy. Know what you are looking for? This notice provides information about two tax rates. Within this site you will find general information about the. . Portland Texas Property Tax Rate.

From printablemapforyou.com

How Does Your State Rank On Property Taxes? 2019 State Rankings Texas Property Tax Map Portland Texas Property Tax Rate rates are calculated by dividing the total amount of taxes by the current taxable value with adjustments as required by state law. please contact the appraisal district to verify all information for accuracy. the city of portland, like other taxing entities, uses the taxable value of properties to set tax rates and generate tax. welcome to. Portland Texas Property Tax Rate.

From my-unit-property.netlify.app

Texas County Property Tax Rate Map Portland Texas Property Tax Rate Know what you are looking for? this notice concerns the 2022 property tax rates for city of portland. this notice concerns the 2024 property tax rates for city of portland. This notice provides information about two tax rates. This notice provides information about two tax rates. welcome to the san patricio county appraisal district website! this. Portland Texas Property Tax Rate.

From www.honestaustin.com

What Are the Tax Rates in Texas? Texapedia Portland Texas Property Tax Rate this notice concerns the 2024 property tax rates for city of portland. This notice provides information about two tax rates. welcome to the san patricio county appraisal district website! This notice provides information about two tax rates. Within this site you will find general information about the. please contact the appraisal district to verify all information for. Portland Texas Property Tax Rate.

From taxfoundation.org

How High Are Property Tax Collections Where You Live? Tax Foundation Portland Texas Property Tax Rate rates are calculated by dividing the total amount of taxes by the current taxable value with adjustments as required by state law. Know what you are looking for? please contact the appraisal district to verify all information for accuracy. welcome to the san patricio county appraisal district website! the city of portland, like other taxing entities,. Portland Texas Property Tax Rate.

From texasscorecard.com

Where Does Texas Rank on Property Taxes? Texas Scorecard Portland Texas Property Tax Rate This notice provides information about two tax rates. Know what you are looking for? This notice provides information about two tax rates. rates are calculated by dividing the total amount of taxes by the current taxable value with adjustments as required by state law. this notice concerns the 2024 property tax rates for city of portland. Within this. Portland Texas Property Tax Rate.

From johnsonandstarr.com

5 Things to Know About Commercial Property Tax Rates in Texas Johnson & Starr Texas Property Portland Texas Property Tax Rate this notice concerns the 2022 property tax rates for city of portland. Within this site you will find general information about the. This notice provides information about two tax rates. this notice concerns the 2024 property tax rates for city of portland. this notice concerns the 2023 property tax rates for city of portland. please contact. Portland Texas Property Tax Rate.

From www.slideteam.net

Texas Property Tax Rate In Powerpoint And Google Slides Cpb Portland Texas Property Tax Rate this notice concerns the 2023 property tax rates for city of portland. Within this site you will find general information about the. This notice provides information about two tax rates. the city of portland, like other taxing entities, uses the taxable value of properties to set tax rates and generate tax. This notice provides information about two tax. Portland Texas Property Tax Rate.

From propertyownersalliance.org

How High Are Property Taxes in Your State? American Property Owners Alliance Portland Texas Property Tax Rate this notice concerns the 2022 property tax rates for city of portland. This notice provides information about two tax rates. Within this site you will find general information about the. this notice concerns the 2023 property tax rates for city of portland. the city of portland, like other taxing entities, uses the taxable value of properties to. Portland Texas Property Tax Rate.

From www.primecorporateservices.com

Comparing Property Tax Rates State By State Prime Corporate Services Portland Texas Property Tax Rate This notice provides information about two tax rates. This notice provides information about two tax rates. the city of portland, like other taxing entities, uses the taxable value of properties to set tax rates and generate tax. this notice concerns the 2023 property tax rates for city of portland. Know what you are looking for? This notice provides. Portland Texas Property Tax Rate.

From dxobljeuf.blob.core.windows.net

Grimes County Texas Property Tax Rate at Pete Cruz blog Portland Texas Property Tax Rate the city of portland, like other taxing entities, uses the taxable value of properties to set tax rates and generate tax. This notice provides information about two tax rates. Know what you are looking for? This notice provides information about two tax rates. rates are calculated by dividing the total amount of taxes by the current taxable value. Portland Texas Property Tax Rate.

From www.newsncr.com

These States Have the Highest Property Tax Rates Portland Texas Property Tax Rate welcome to the san patricio county appraisal district website! this notice concerns the 2022 property tax rates for city of portland. this notice concerns the 2023 property tax rates for city of portland. please contact the appraisal district to verify all information for accuracy. Within this site you will find general information about the. Know what. Portland Texas Property Tax Rate.

From cmi-tax.com

Texas Property Tax Rates Cantrell McCulloch, Inc. Property Tax Advisors Portland Texas Property Tax Rate the city of portland, like other taxing entities, uses the taxable value of properties to set tax rates and generate tax. please contact the appraisal district to verify all information for accuracy. This notice provides information about two tax rates. rates are calculated by dividing the total amount of taxes by the current taxable value with adjustments. Portland Texas Property Tax Rate.

From exoskvmtl.blob.core.windows.net

Texas Property Tax By Address at Lorita Holderman blog Portland Texas Property Tax Rate This notice provides information about two tax rates. Within this site you will find general information about the. This notice provides information about two tax rates. this notice concerns the 2022 property tax rates for city of portland. the city of portland, like other taxing entities, uses the taxable value of properties to set tax rates and generate. Portland Texas Property Tax Rate.

From taxfoundation.org

Ranking Property Taxes by State Property Tax Ranking Tax Foundation Portland Texas Property Tax Rate this notice concerns the 2023 property tax rates for city of portland. This notice provides information about two tax rates. Know what you are looking for? This notice provides information about two tax rates. the city of portland, like other taxing entities, uses the taxable value of properties to set tax rates and generate tax. welcome to. Portland Texas Property Tax Rate.

From www.realtyonegroupprosper.com

Where Do Texans Pay The Highest Property Taxes? Portland Texas Property Tax Rate this notice concerns the 2023 property tax rates for city of portland. This notice provides information about two tax rates. rates are calculated by dividing the total amount of taxes by the current taxable value with adjustments as required by state law. Know what you are looking for? the city of portland, like other taxing entities, uses. Portland Texas Property Tax Rate.

From johnsonandstarr.com

5 Counties in Texas with the Highest Property Tax Rate in 2023 Johnson & Starr Texas Portland Texas Property Tax Rate rates are calculated by dividing the total amount of taxes by the current taxable value with adjustments as required by state law. welcome to the san patricio county appraisal district website! the city of portland, like other taxing entities, uses the taxable value of properties to set tax rates and generate tax. please contact the appraisal. Portland Texas Property Tax Rate.

From 4printablemap.com

Property Tax In The United States Wikipedia Texas Property Tax Map Printable Maps Portland Texas Property Tax Rate Within this site you will find general information about the. This notice provides information about two tax rates. please contact the appraisal district to verify all information for accuracy. the city of portland, like other taxing entities, uses the taxable value of properties to set tax rates and generate tax. this notice concerns the 2024 property tax. Portland Texas Property Tax Rate.